Executive Summary

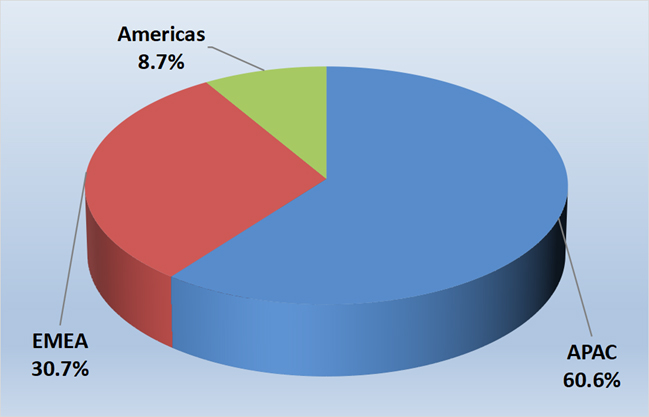

By year-end 2022, over 1.000 public hydrogen stations were deployed globally, representing a significant increase over 2021. These deployments represent the highest number of station deployments in a single year. Figure 1 shows the breakdown of these stations by region.

The deployments of hydrogen stations have picked up in several countries, particularly in APAC and Europe. In 2022, the highest number of new hydrogen stations were deployed in China, followed by Japan and South Korea. In Europe, France led the new deployments.

With 2022 as the base year, this study provides 15-year forecasts through the year 2037. During the forecast period, the deployments of hydrogen stations will grow as a function of their declining costs and the uptake of hydrogen FCVs.

The capabilities of hydrogen stations are being enhanced, such as higher fueling pressures, increased fueling capacity, and expanded hydrogen storage.

There is a push to supply these stations with “green” hydrogen, i.e., hydrogen produced from clean energy sources such as solar panels and wind turbines. This trend is in line with the global drive for green energy completely free of carbon as the source of fuel.

Information Trends projects that by 2030, the hydrogen industry in many countries will become sufficiently self-reliant and independent so as not to need any intervention from governmental organizations for financial sustenance.

Figure 1: Global Hydrogen Station Deployments by Region, 2022

Source: Information Trends

South Korea, Austria, and Denmark are the first countries where enough hydrogen stations were deployed to allow an FCV to travel across the country. In the U.S., hydrogen station deployments in California allow an FCV to travel across the state and be supported by a hydrogen fueling network.

In addition to hydrogen stations for passenger vehicles, hydrogen stations for heavy-duty transportation are increasingly being deployed. These include stations for buses, trucks, and forklifts. Hydrogen fueling for trains and maritime vessels, and hydrogen stations for aircraft are in the offing.

Scope of the Study

This is a comprehensive research study on the rapidly evolving market for hydrogen fueling stations globally. The focus of the study is hydrogen stations being built to support vehicular transportation encompassing cars, SUVs, minivans, buses, and trucks, in addition to forklifts, trains, and maritime vessels.The study analyzes major industry trends and discusses vendor strategies in building the infrastructure needed to drive the hydrogen FCV market. The study provides forecasts for hydrogen station deployments and vendor revenues. It contains detailed data for each region, and for some of the major countries in each region.

In this study, hydrogen stations are classified as retail, non-retail, and private.

• Retail stations: These are designed for light-duty passenger non-commercial vehicles and bicycles.

• Non-retail stations: These are designed for commercial vehicles, such as buses, trucks, forklifts, locomotives, and maritime vessels.

• Private stations: These stations are being used by companies and organizations for their internal needs. They include stations are being used for trials and R&D.

Both retail and non-retail stations are considered public. In quantifying the market, this study considers only retail and non-retail stations. This study does not consider Hydrogen-enriched Compressed Natural Gas (HCNG) stations as part of the hydrogen station market. Hydrogen stations offering compression levels below 20-MPa are also beyond the scope of this study.

Executive Summary

Press Release

Table of Contents

Order Study |